Finlytica: Banking Insights as a Service

Banks and Credit Unions understand that in light of current challenges they need to do more with their data to understand current customers and acquire new profitable customers. Many assume that the only way to get there is hire expensive and hard to find data scientists or just get by with what they have.

A better way is to partner with a company that is expert in the application of Data and AI Analytics.

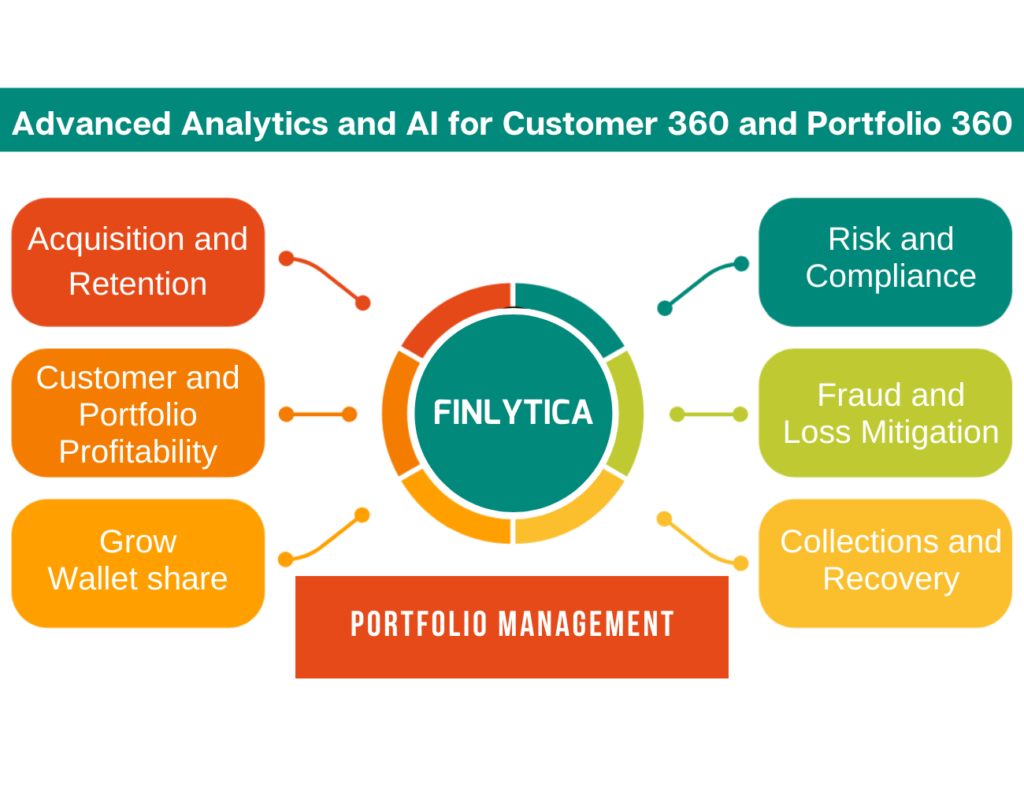

We have developed an out-of-the-box Advanced Analytics platform that helps banks and credit unions grow their business quickly and cost-effectively through better data insights.

Our Advanced Banking Analytics Solution delivers a consolidated view of data along with pre-built machine learning models and visualizations to deliver key predictive insights into customer attrition, personalized marketing, BSA and AML, customer experience, and operations.

Why choose us

Travel and Aviation

Consulting

Consultants ranked firms on a scale of one to 10, based on prestige, firm culture, work-life balance, compensation, and other factors.

Financial Services

Consulting

We are a dynamic niche consulting firm that has been helping visionary financial services brands convey their true essence.

Business Services

Consulting

We have had to start competing on quality of life in a way that they never had to before — leading to higher ratings from consultants.

Energy and Environment

Consulting

Engage with consumers and inspire the media — we ensure brands are seen and heard in all the right places.

Consumer Products

Consulting

We are a company that offers design and build services for you from initial sketches to the final construction.

Surface Transport

& Logistics Consulting

The ConsultingWP firm scored highest for vacation policy, hours in the office, and overall satisfaction.

We deliver key insights to drive your business forward using data and AI.

To grow revenue while managing risk, smaller financial institutions today face increased competition from larger banks and lesser regulated Fintechs. Smaller institutions need increased digital outreach but are challenged by lack of digital resources and expertise. They need to grow revenue while managing risk and compliance.

Revenue Growth

Grow revenue from new and existing customers. Focused data insights help you profile your most valuable customers and find more of the same. Help you pinpoint immediate upsell and cross-sell opportunities. And deliver personalized product and service recommendations for customers.

Digital Transformation

Digital transformation drives revenue and cost savings, but it requires skills and resources many banks and credit unions lack. We help our clients get a 360 View of their Customer relationships and portfolios. Our advanced analytics tools support marketing and compliance and keep our clients at the forefront of digital transformation.

Customer Experience

The world is more digital. Many customers prefer a digital channel for their banking. How do you maintain strong customer relationships in the new digital world? Our proven AI models can help reduce attrition. Data insights can help improve customer experience.

Risk and Compliance

Increasing demands from risk and regulatory compliance are a given. Banks and credit unions are challenged with meeting these requirements while also achieving their revenue and profit goals. Our analytics insights help manage risk, identify potential fraud, and streamline regulatory compliance, building a foundation to better support new regulations like CECL.

Resources

Announcement

SAS recognizes PKSI with the Excellence in Innovation Award for 2020, for the PKSI Advanced Workforce Analytics (AWA) product.

Advanced Analytics Made Easy

Our predictive analytics solution is platform agnostic and hence can be easily integrated into any existing set up with minimum requirements and can also be accessed via cloud on any device. You get the insights of our Data Scientists without expensive resource, systems and equipment investments.

Capture Diverse and Valuable Data Sets

Our predictive solution can ingest raw data from any source be it flat files, spreadsheets, database, structured and unstructured data to have a single consistent view, as opposed to segregated records scattered throughout different businesses units. Data sources may include HRIS, Payroll, Application Tracking Systems, and other structured or unstructured data like Emails, Performance Reviews, Logs, Surveys. We also bring in 3rd party data sets like socio-economic, financial or demographic data for richer insights as needed.

Visualize on the Go

View your Dashboards on the Cloud or at your desk. If you already have a preferred visualization tool, we can work with that too! We will build the dashboards to suit your needs. All you need to do is use them

Awards